Article at a Glance:

- Americans without insurance face significantly higher prescription costs, with some medications costing hundreds of dollars for a 30-day supply

- Pharmacies often charge uninsured patients “usual and customary” prices, which can be dramatically higher than what insured patients pay for identical medications

- Legitimate money-saving options include discount cards/apps, manufacturer assistance programs, online pharmacies, and therapeutic strategies like pill splitting (with doctor approval)

- Asking specific questions at the pharmacy counter can yield substantial savings, as pharmacists often can’t volunteer lower price options due to contract restrictions

- Strategic approaches like medication synchronization, quantity optimization, and exploring generic alternatives can further reduce costs

Navigating prescription costs without insurance requires becoming a savvy healthcare consumer who knows how to ask the right questions and explore multiple avenues for obtaining affordable medications.

That sinking feeling hits when you see the total on your pharmacy’s checkout page: $347.62 for a 30-day supply of medication you need to take daily. Without insurance, this monthly expense wasn’t in your budget.

You’re not alone. Many Americans lack health insurance, and millions more have coverage with high deductibles or limited prescription benefits. Studies have shown that Americans face significantly higher cost of prescriptions without insurance compared to those in other developed countries.

This guide offers practical strategies to navigate the complex world of prescription medications without insurance coverage. From understanding the pricing structures of the pharmaceutical system to finding legitimate online options and discount programs, you’ll discover actionable approaches to significantly reduce your medication costs while maintaining your health.

Understanding Prescription Pricing in the US

Pharmacies may not always mention lower prices unless asked, as pricing is influenced by complex agreements between pharmacies, drug manufacturers, and pharmacy benefit managers (PBMs), who help negotiate costs.

When you stand at the pharmacy counter without insurance, you’re charged what industry insiders call the “usual and customary” price. This price can be significantly higher than what insured patients or government programs pay for the exact same medication.

Questions to Ask Your Pharmacist:

- “Is this the lowest possible price you can offer?”

- “Do you have any discount programs I can use?”

- “Is there a cheaper, generic version of this medication?”

- “Would the price be lower if I paid cash instead of using my insurance?”

- “Would a 90-day supply be cheaper per pill?”

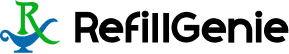

Several factors influence what you’ll pay:

- Geographic location: Prices can vary between pharmacies in the same city.

- Pharmacy type: Independent pharmacies may offer competitive cash prices compared to chain pharmacies, depending on your medication and location.

- Medication type: Generic availability dramatically affects pricing.

- Quantity purchased: Larger supplies (90-day vs. 30-day) often cost less per pill.

- Pharmacy benefit manager contracts: These agreements can restrict how pharmacies can price medications.

The strangest part? Sometimes paying without insurance proves cheaper than using your coverage. This happens when your copay exceeds the pharmacy’s actual acquisition cost plus a reasonable dispensing fee.

To navigate this system, you’ll need to become a savvy healthcare consumer—someone who knows how to ask the right questions and explore multiple avenues for obtaining medications.

Online Pharmacy Options and Evaluation

The digital revolution has transformed how we shop for everything—including prescription medications. Online pharmacies offer convenience and often significant savings, but the marketplace includes both legitimate operators and dangerous scammers.

Types of online pharmacies Several business models exist, each with different pricing structures:

Direct-to-consumer pharmacies operate their own dispensing facilities and deliver directly to patients. Without physical storefronts, their overhead costs drop, often resulting in better pricing.

Marketplace platforms connect consumers with various pharmacy partners. They may offer competitive pricing through volume purchasing but add middleman fees.

Membership-based pharmacy services charge monthly or annual fees for access to significantly discounted medications. These provide exceptional value for people taking multiple regular prescriptions.

Mail-order pharmacies affiliated with insurance companies also serve cash-paying customers, sometimes at reasonable rates.

Safety verification essentials Before ordering, verify legitimacy through these critical steps:

- Look for websites with the “.pharmacy” domain, which indicates verification by the National Association of Boards of Pharmacy

- Confirm they require valid prescriptions from licensed healthcare providers

- Verify they have licensed pharmacists available for consultation

- Check for a legitimate U.S. address and phone number

- Ensure they’re licensed in your state

Red flags that suggest a fraudulent operation include selling prescription medications without requiring prescriptions, extremely low prices that seem unrealistic, and websites that lack secure connection protocols or clear contact information.

Comparing services beyond price When evaluating online pharmacies, consider:

- Refill policies: How easy is it to set up automatic refills?

- Consultation access: Can you speak with a pharmacist if needed?

- Shipping costs and timeframes: Will your medication arrive when needed?

- Packaging security: Are temperature-sensitive medications properly handled?

- Privacy practices: How is your health information protected?

- Insurance coordination: If you gain insurance later, can they work with your provider?

Some online pharmacies excel at handling specific medication types. For example, certain platforms specialize in chronic condition medications while others better serve patients needing acute prescriptions.

Remember that even legitimate online pharmacies have limitations. They might not suit urgent medication needs or controlled substances with special dispensing requirements.

Prescription Discount Programs and Resources

The gap between retail prices and what’s actually paid for medications has spawned an entire industry of discount programs designed to help uninsured and underinsured patients manage the cost of prescriptions without insurance.

Pharmacy discount cards and apps Free prescription discount programs have transformed how uninsured Americans purchase medications. These services negotiate rates with pharmacies and pass savings to consumers through digital coupons or physical discount cards.

How they work: Rather than processing your prescription through insurance, the pharmacy runs it through the discount program’s group. The discount service receives a small referral fee from the pharmacy for directing your business to them.

Potential savings vary dramatically by medication—ranging from modest discounts to substantial price reductions. For maximum benefit:

- Compare prices across multiple discount programs before purchasing

- Check different pharmacy options within each program

- Consider location factors (sometimes driving an extra mile saves significant money)

- Ask the pharmacist if they offer better cash prices than what the discount card shows

Interestingly, discount cards sometimes secure better prices than insurance copays, making them valuable tools even for those with coverage.

Manufacturer assistance programs

Pharmaceutical companies establish Patient Assistance Programs (PAPs) to provide free or heavily discounted medications to qualifying patients. These programs typically:

- Target people within specific income ranges (often based on the Federal Poverty Level)

- Require proof of financial need and U.S. residency

- Need documentation of insurance status or denial

- Involve application processes of varying complexity

For brand-name medications still under patent protection, manufacturer programs often provide the most significant savings. The Partnership for Prescription Assistance and similar resources help match patients with appropriate programs.

The application process typically requires:

- Income verification

- Prescription documentation

- Healthcare provider participation

- Insurance status verification

- Residency proof

Most manufacturer programs cover 3-12 months of medication before requiring renewal.

Nonprofit and community resources Beyond commercial discount cards and manufacturer programs, numerous community resources can help:

- State Pharmaceutical Assistance Programs: Many states offer medication assistance for residents who don’t qualify for Medicaid but still have financial need.

- Community health centers: Federally Qualified Health Centers provide medications at reduced costs.

- Hospital charity care programs: Some hospital systems include prescription assistance.

- Disease-specific foundations: Organizations focusing on specific conditions often provide medication assistance.

- Local religious organizations: Many churches and religious groups maintain emergency assistance funds.

Finding these resources requires persistence. Community resource navigators at local health departments or United Way organizations can often point you toward programs for which you might qualify.

Strategic Approaches to Medication Management

Beyond finding the best price for your current prescriptions, several strategic approaches can substantially reduce your overall medication costs.

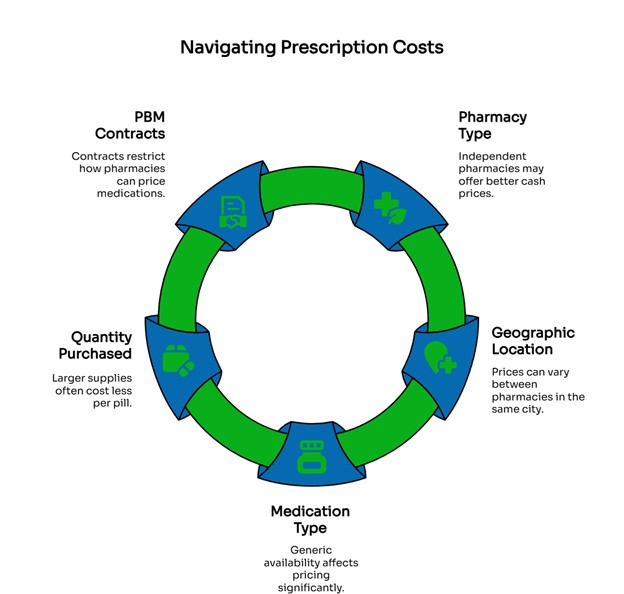

Generic vs. brand-name considerations: The average generic medication costs significantly less than its brand-name equivalent, with identical active ingredients and effectiveness. Consider these factors:

- Some patients report different responses to certain generic formulations due to inactive ingredients, according to medical literature on medication bioequivalence

- Narrow therapeutic index drugs (medications where small changes in blood levels can significantly affect outcomes, such as certain anti-seizure medications, blood thinners, and thyroid medications) sometimes warrant brand consistency

- Certain brand-name medications have no generic alternatives yet

- Some branded drugs offer copay assistance while their generic versions don’t

WARNING: Always consult your healthcare provider before switching between brand-name and generic medications, particularly for conditions requiring precise medication levels. Never change medications without explicit medical guidance and a new prescription.

Dose splitting and quantity adjustments with physician approval only, these approaches can create substantial savings:

Pill splitting: When medications are similarly priced across different strengths, purchasing higher-strength pills and splitting them can cut costs nearly in half.

IMPORTANT SAFETY WARNING: Pill splitting carries significant risks and should never be attempted without all of the following:

- Explicit doctor approval

- Pharmacist confirmation that the specific medication can be safely split

- Medications that can be safely split (tablets without special coatings, time-release properties, or unusual shapes)

- Proper pill-splitting tools

- Physical ability to split pills accurately

- Regular follow-up with your healthcare provider

Never split capsules, extended-release tablets, pills with special coatings, or any medication without your doctor’s specific approval for that exact medication.

Quantity optimization: Some medications cost almost the same regardless of whether you get 30, 60, or 90 pills. Getting larger quantities when appropriate reduces per-dose costs and pharmacy fees.

Therapeutic substitution: Sometimes switching to a different medication in the same therapeutic class offers better pricing. For example, one statin cholesterol medication might cost significantly less than another with similar effects.

CRITICAL WARNING: Never substitute one medication for another without your doctor’s explicit approval and a new prescription. Medications in the same class can have different effects, side effects, and interactions. What works well for one person may not work for another.

Talk to Your Doctor Checklist When discussing medication costs with your healthcare provider, ask these specific questions:

- “Are there generic alternatives to the medications you’re prescribing?”

- “Can any of my medications be safely split to reduce costs?”

- “Would a different medication in the same class be equally effective but more affordable?”

- “Can you prescribe a 90-day supply to reduce per-fill costs?”

- “Are there any manufacturer discount programs for my medications?”

- “Would therapeutic alternatives like diet, exercise, or other treatments reduce my medication needs?”

- “Can you provide any samples to help me get started while I arrange affordable refills?”

- “Are any of my medications available through special discount programs?”

Remember: Never change your medication regimen without explicit healthcare provider approval. Saving money should never compromise your health.

Prescription bundling and timing optimization Strategically timing your prescription refills and doctor appointments yields significant savings:

- Synchronize multiple medications: Having all prescriptions filled on the same schedule reduces transportation costs and sometimes qualifies for pharmacy discounts.

- Align prescription renewals with doctor appointments: This minimizes the need for separate visits just for refill authorizations.

- Consider prescription timing relative to insurance changes: If you expect to gain coverage soon, discuss with your doctor whether your treatment plan can accommodate timing adjustments until coverage begins.

- Schedule appointments strategically: Some assistance programs require recent doctor visits, so timing these with actual medical needs maximizes value.

Some pharmacies offer formal “med sync” programs that coordinate all your prescriptions to be filled on the same day each month, often providing modest additional discounts.

Long-term Solutions and Healthcare Planning

While the strategies above help manage immediate medication needs, developing a sustainable approach to healthcare access remains important.

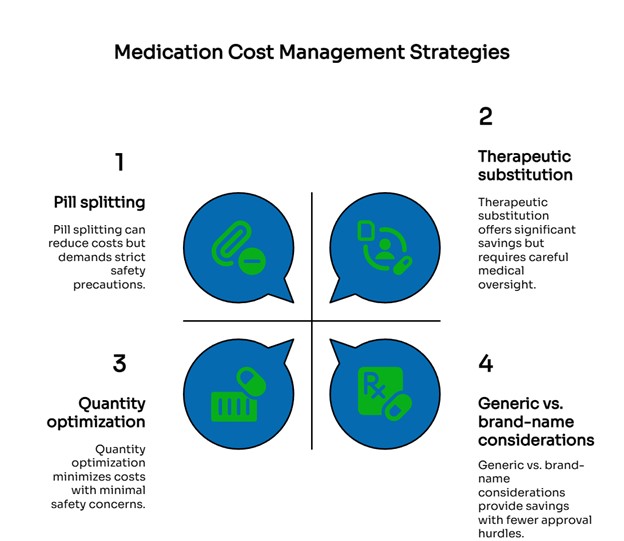

Building a sustainable medication budget

Creating financial stability around your healthcare needs involves:

- Medication cost averaging: Calculate your total annual medication expenses and divide by 12 to determine monthly budget needs.

- Healthcare savings options: Understand that tax-advantaged health savings accounts (HSAs) specifically require enrollment in a qualifying High Deductible Health Plan (HDHP). Without an HDHP, you cannot contribute to an HSA. However, other options like Flexible Spending Accounts (FSAs) might be available through employers.

- Prioritization planning: Work with your healthcare provider to identify which medications are absolute necessities versus those with more flexibility.

- Drug holiday discussions: For some conditions and medications, physician-supervised medication breaks might be appropriate and cost-effective.

- Alternative therapy integration: Some conditions respond to non-pharmaceutical interventions that may reduce medication dependence.

When budgeting, remember that prescription needs often change. Build in a contingency fund for potential new medications or dosage adjustments.

Healthcare marketplace options for future coverage Even with strategic prescription management, comprehensive health coverage often provides better long-term protection:

- ACA Marketplace plans: Subsidies make these more affordable than many realize, with special enrollment periods available for certain life changes.

- Medicaid expansion: Many states have expanded eligibility—check current requirements even if you didn’t qualify previously.

- Professional association plans: Some professional groups offer access to group rates.

- Short-term coverage: These plans typically offer very limited prescription benefits and primarily cover major medical emergencies. They should not be relied upon for ongoing prescription coverage needs.

When evaluating potential insurance options, look beyond the monthly premium to understand prescription coverage specifics:

- Formulary inclusion for your specific medications

- Prior authorization requirements

- Pharmacy network restrictions

- Deductible structure and how it applies to prescriptions

Preparing for healthcare policy changes The pharmaceutical pricing landscape continues to evolve:

- Patent expirations: Research upcoming patent expirations for brand-name medications you take, as generic introduction typically brings substantial price reductions.

- Policy monitoring: Stay informed about federal and state legislation affecting drug pricing and importation rules.

- Program expansion awareness: Many assistance programs periodically adjust their qualification requirements.

- Emerging pharmacy models: New consumer-focused pharmacy operations continue entering the market with innovative pricing approaches.

Setting up news alerts for your specific medications and healthcare policy changes helps you stay ahead of opportunities to reduce costs further.

Taking Control of Your Prescription Costs

The American healthcare system can be challenging to navigate, especially for those without insurance. Yet armed with knowledge and strategic approaches, you can significantly reduce what you pay for necessary medications.

Remember that persistence pays off. The first price quoted rarely represents the best available, and combining multiple strategies—discount programs, manufacturer assistance, optimal prescription management, and pharmacy comparison—often yields better results than relying on any single approach.

Most importantly, maintain open communication with your healthcare providers about financial concerns. Doctors and pharmacists can often suggest alternatives or workarounds when they understand your situation.

Your health shouldn’t be compromised by medication costs. With the tools and strategies in this guide, you can develop a sustainable approach to managing your prescriptions without insurance—keeping both your health and finances in better shape.

Frequently Asked Questions (FAQs)

Q: How much can I expect to save using online pharmacies versus traditional retail pharmacies without insurance?

A: Online pharmacies typically offer savings compared to traditional retail pharmacies. For specific savings calculations and factors that affect these numbers, see the “Online Pharmacy Options” section.

Q: Are prescription discount cards legitimate?

A: Yes, these services are legitimate and negotiate lower rates with pharmacies. For details on how they work and how to maximize your savings with them, refer to the “Prescription Discount Programs” section.

Q: What verification should I look for to ensure an online pharmacy is safe?

A: Look for the “.pharmacy” domain and other safety markers discussed in the “Safety verification essentials” portion of the “Online Pharmacy Options” section.

How can I approach my doctor about prescribing more affordable medication alternatives? Review the “Talk to Your Doctor Checklist” section for specific questions and approaches that will help you have this important conversation effectively.

Q: What are patient assistance programs (PAPs), and how do I qualify for them?

A: These manufacturer-sponsored programs provide free or discounted medications based on financial need. See the “Manufacturer assistance programs” section for qualification details and application guidance.

Frequently Unasked Questions (FUQs)

Q: How might pharmacy benefit manager (PBM) practices affect the cash price I pay without insurance?

A: PBM contracts often prevent pharmacists from voluntarily telling you about lower-cost options unless specifically asked. This explains why identical medication prices vary dramatically between neighboring pharmacies. Always ask, “Is this your lowest possible price?” or “Do you have any discount programs available?” These simple questions can potentially save substantial money because they give pharmacists permission to discuss options their contracts might otherwise prohibit them from volunteering.

Q: What healthcare policy changes should I monitor that could affect my prescription costs?

A: Several policy developments could significantly impact prescription costs for uninsured patients. Monitor drug pricing reform legislation, expansion of state pharmaceutical assistance programs, potential changes to medication importation rules, and modifications to healthcare marketplace subsidies. Additionally, track pharmaceutical patent expirations for medications you take regularly, as these events typically bring new generic alternatives to market at substantially lower prices. Setting up news alerts for your specific medications and healthcare policy terms helps you stay informed about opportunities for cost reduction as the regulatory landscape evolves.

Q: How do pharmacy location demographics influence the pricing I might receive without insurance?

A: Pharmacies in different socioeconomic areas often implement different pricing structures, even within the same chain. Stores in lower-income neighborhoods may offer certain generic medications at different cash prices due to local competition and customer base considerations. Some patients report saving by filling prescriptions at pharmacies in different zip codes within the same city. This pricing variation makes comparison shopping across different areas particularly valuable for expensive or frequently refilled medications.

Take Control of Your Prescription Costs—Refill Affordably Today

At Refill Genie, we understand how overwhelming the cost of prescriptions without insurance can be. That’s why we specialize in providing fast, affordable, and hassle-free online prescription refills—no insurance required. Whether you need essential medications like Metformin, Zoloft, Lisinopril, or Levothyroxine, we’re here to help you skip the pharmacy lines and save money without compromising your health.

With thousands of satisfied customers and years of experience in online prescription refills, Refill Genie is your trusted partner in navigating healthcare costs.

Ready to simplify your prescription experience?

👉 Refill Now and get your medication delivered discreetly and affordably.

👉 Explore our services to see how we can help you stay on top of your health—without breaking the bank.

Because managing your prescriptions shouldn’t be another financial burden. Let Refill Genie lighten the load—refill smarter, save more, and stay healthy.